You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The majority of retail investor accounts lose money when trading CFDs. You must assess and consider them carefully before making any decision about using our products or services.ĬFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should only trade in these products if you fully understand the risks involved and can afford losses without adversely affecting your lifestyle (including the risk of losing the entirety of your initial investment). Forex and CFDs are highly leveraged products which mean both gains and losses are magnified. You should carefully consider your objectives, financial situation, needs and level of experience before entering into any margined transactions with Eightcap, and seek independent advice if necessary. Risk Warning: Margin trading involves a high level of risk, and may not be suitable for all investors. A bearish flag will occur in a downtrend. A stop loss should be placed below the lowest point of the flag.

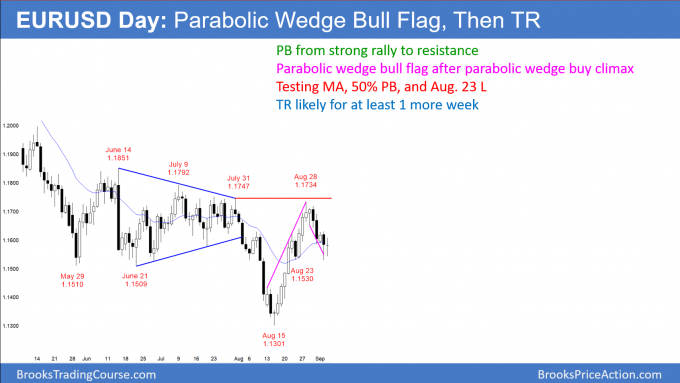

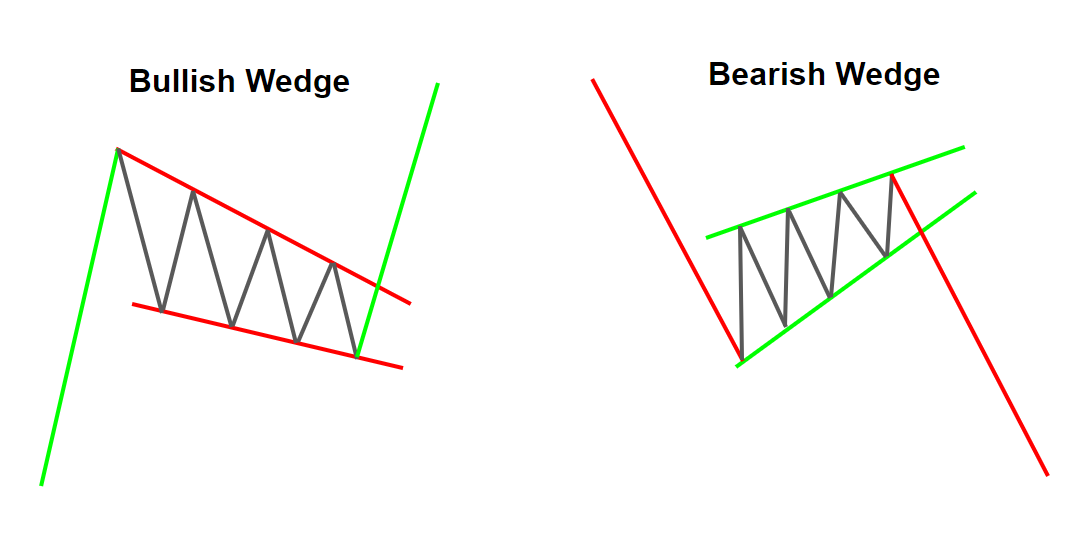

The pattern is triggered when the price breaks the upper channel with a target the same height as the up move preceding that flag. Prices form a neat channel that gradually drifts lower. The bullish flagrepresents a neat consolidation pattern that occurs in an uptrend. Rising wedges (bearish) and falling wedges (bullish).Triple tops (bearish) and triple bottoms (bullish).However, the price level will climb once more before reversing back against the current trend. This is when the price of a certain asset will hit a peak before falling back to the support level. Double tops (bearish) and double bottoms (bullish).The target is the height of the head (the middle peak) and the pattern fails if the high of the right shoulder is breached.Īn upside-down, or inverse head and shoulders is a bullish pattern that occurs after prices have fallen. A short trade is triggered when the neckline is broken. It then makes a lower high and falls back to the same level, forming a neckline and completing the pattern. Traders may prefer to use one pattern over another but they all vary slightly to show different trends for a certain asset class.Īfter forming a higher high, the price falls all the way back to where that high began. All chart patterns can be bullish or bearish depending on the structure of the pattern and the direction of the prior trend. These patterns form when prices consolidate before either continuing in the direction of the trend or reversing the previous trend. With a bit of practice, chart patterns are easy to spot, allowing traders to quickly scan lots of charts to identify opportunities.Ĭhart patterns have specific rules regarding trade entry and the levels to use for profit targets and stop losses. Most patterns either signal a potential continuation or a reversal of the prior trend, however, some can lead to both depending on the direction in which they break out. The movements of asset prices often form recognisable patterns with fairly predictable outcomes. Trading patterns show certain shapes within a price chart, this could indicate future price movements based on previous patterns.

0 kommentar(er)

0 kommentar(er)